Sep 18, · Include Financial Statements in Your Business Plan. You will need a complete startup business plan to take to a bank or other business lender. The financial statements are a key part of this plan. Give the main points in the executive summary and include all the statements in the financial section Oct 06, · An example of financial statements for a small business owner is a business owner should also include information regarding the payment of employee taxes to the state in which the business is incorporated and is blogger.comted Reading Time: 4 mins Jul 29, · Use this financial plan template to organize and prepare the financial section of your business plan. This customizable template has room to provide a financial overview, any important assumptions, key financial indicators and ratios, a break-even analysis, and pro forma financial statements to share key financial data with potential investors

Financial Statements for Business Plans and Startup

If you are a first-time entrepreneursuch questions might give you a tough time, and why not, finance is in-arguably the most important section of a business plan financial statement example plan. No matter what your vision is, how impeccable your marketing strategies are, and what you aim to conquer with your product, in the end, everything boils down to how much your idea can make earn at the business plan financial statement example of the day.

Hence, it is critical to justify your business with good figures. This is done by filling accurate numbers in the business plan and elaborating them in a way that genuinely makes your business sound like a profitable venture to investors.

Basically, the financial section will demonstrate whether or not your business idea is viable, and whether or not your plan is going to be able to attract any investment in your business idea.

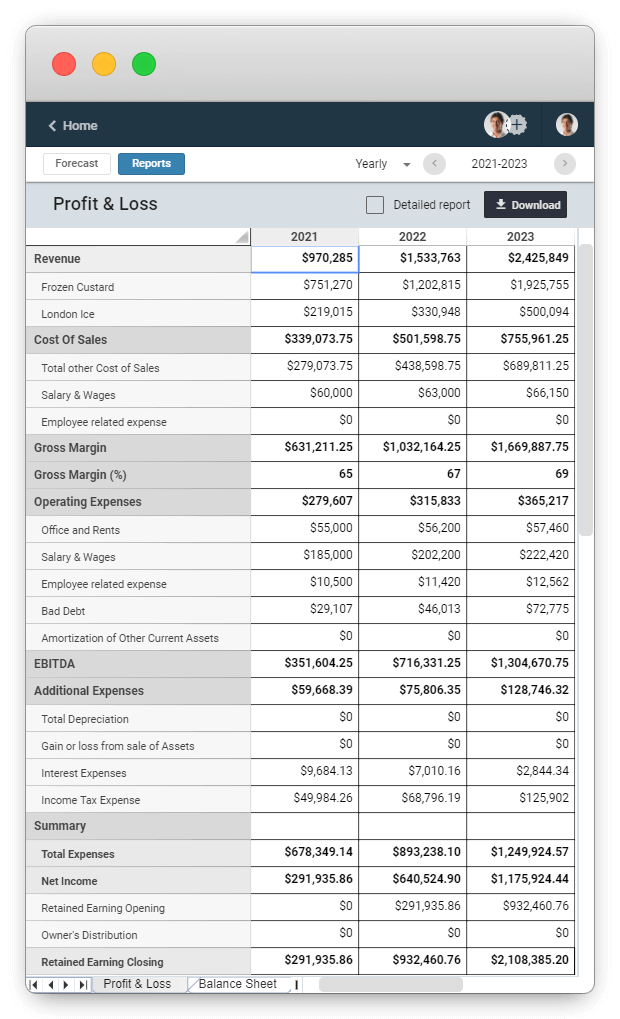

Here is an example of Airbnb Financial Traction. In this article, we'll outline the fundamentals of a good financial plan that will provide a clear picture of your company's current value, as well as the ability of your idea to earn a profit in the future. This information is very important to business plan readers. The financial section in a business plan is divided into three segments - income statementcash flow projection, and the balance sheetalong with a brief analysis of these three statements.

These three important statements are the bird view of the financial stats of your organization. Apart from this break-even analysis might also be asked by investors to understand when your startup taking off the profits.

In a nutshell, the Income Statement shows your expenses, revenues, and profits for a particular period. Basically, it is a snapshot of your business that business plan financial statement example the feasibility of the business idea.

The Income statement can be generated keeping into consideration three scenarios: worstexpectedand best. While established businesses are required to produce Income Statements annually, startups and small businesses should provide monthly reports while writing a business plan.

This section provides details on the cash position of the business and its ability to meet monetary commitments on a timely basis. A startup business should show monthly projections for the first year of business, along with quarterly information for the next two years. When writing a business plan, you'll be required to show Cash Flow Projections for each month over a period of one year as part of the Financial Plan of your startup.

The Cash Flow Projections consists of three parts:. Cash Revenue Projection - Here you have to enter the estimated or expected sales figures for each month. Cash Disbursements - This will take into account various expenses across categories. List out expenditures that you expect to pay in cash for each month over a period of one year. Reconciliation of Cash Revenues to Cash Disbursements - Reconciliation here signifies adding the current month's revenues and subtracting the current month's disbursements.

The result is then adjusted to the cash flow balance that is carried over to the next month, business plan financial statement example. A balance sheet adds up everything your business owns, subtracts all debts, and the difference that you get shows the net worth of the business, also referred to as equity. This statement consists of three parts: assets, liabilities, and the balance calculated by the difference between the first two.

The purpose of the balance sheet:. The investor wants to see your balance sheet to understand the condition of your business on a given date, which is usually the end of the fiscal year. While writing a business plan for a new venture, you will have to work on creating projections for Balance sheets.

These will serve as the benchmarks to compare against actual results at the end of the fiscal year. Hence, it is important to look ahead to see how your balance sheet will appear given your marketing, sales, and inventory forecast - the three components of the business that can have a major impact on your projections. How would you make assumptions while projecting your financials? Remember, while writing a business plan, you're not providing actual data, business plan financial statement example, but an educated guess.

The financial forecast meaning the predictions about the financial stats of the future. As advised in the reference article, Always use What-if scenarios while projecting your financials.

This would increase transparency and help the investor to understand the bestexpected, business plan financial statement example, and worst sides of the startup. It is a forecast and thus, it is highly recommended to go with simple math. No one expects you to understand everything.

Do not clutter the financial section by including every small detail, unnecessary more detailed views distract readers from focusing on core digits, There is lots of space available in the appendix of your business plan. attach other detailed statements there in the appendix. If you are using your business plan to get a loan, it is business plan financial statement example recommended to include your business's financial history as part of the financial section.

To auto assemble all of the above-given calculations in the financial section of your business plan, business plan financial statement example, you'd need business planning software to make sure that you get this right in the first attempt itself.

Online Business plan financial statement example Planning Software is designed to help you create projections in the financial section that you can use to highlight the viability of your business idea. Understanding the financials, and if possible, mastering them can help you attract the investment that you need to run your business more smoothly. Learn more about how to calculate financial projections for your business plan. We are in the process of starting a new business and Upmetrics has been invaluable for modeling realistic financials.

Getting a feel for which knobs to turn to improve the chances of success, being able to see the development of your revenue, business plan financial statement example, cash flow, etc. gives a quick overview of what works and what doesn't. Having complete control over the numbers and the business plan has been instrumental in being able to raise funds from investors. Being able to go online and pull up the numbers directly in front of investors really impresses them.

A great product that keeps getting better. When I started developing my business idea, I needed a business plan. After business plan financial statement example a few online business plan services I found Upmetrics, business plan financial statement example.

The templates really sold me on the service as they saved me a ton of time, pro-typing my idea. Upmetrics also has powerful tools that were easy to learn, great customer service and the perfect price. After trying Upmetrics, I wish to highly recommend this app to anyone who needs to write a business plan flexibly and to a high standard.

Seriously, forget about LivePlan, Bizplan or Cuttles. I've tried them all! Thank you Upmetrics for your excellent customer support. Been using Upmetrics for my crypto startup and can only recommend it.

The hours I spent searching for an online business plan template was countless. I love how they are providing an explanation for every single step. You'll get guided from the beginning to the end.

Had some questions and their support service replied and helped in less than 24 hours. Kinda cool! Customer service was great and really no complaints.

There are helpful tips provided on how to complete each section. The charts and visual sections of business plan are pretty cool addition. Overall, it's a helpful resource to aid in completing a business plan. Create an account to write your business plans.

Upmetrics is loved by beginners and experts, teams and individuals. Already have an account? Log In. Brought to you by Upmetricsbusiness plan financial statement example, a 1 business plan toolset powered by an interactive business plan builder, templates and automated financial. Table of Contents. Was this article helpful? Thank you! We have received your rating.

How to write a financial Section for your Startup Business Plan ? BY Sonal Mishra Updated September 23, If you are a newbie, you can use our startup business plan template and a step-by-step guide to start writing your business plan. Get started with upmetrics and start your business financial planning for your startup and never run out of money! Get started with upmetrics and impress your investors by pulling your financial data right in front of them.

Don't forget to share this post! Make your plan in half the time with twice the impact. A Management Graduate with 7 years of experience in content development, Sonal is an Independent Consultant specializing in writing, content strategizing, website optimization, and social communication.

Highly imaginative, focused, creative, explorer and fun - is how she best describes herself! Filter Posts By Categories All Articles Business Planning Starting Your Business Financing Your Business Marketing Startups News How to Write for Upmetrics.

Reach Your Goals with Accurate Planning. Try Upmetrics Today. No Risk - Cancel at Any Time - 15 Day Money Back Guarantee. Jason Lorje CEO at Agmondo. Chris Rosenau CEO at Our Epic Odyssey. Cassandra Davidson CEO at Figure Bridal Boutique. Thanks for trying Upmetrics! We sent you an email that includes a link to activate your login to business plan financial statement example business plan software and business plan financial statement example your signup process.

You might also be interested in reviewing our Knowledge Base. If you have any questions about logging-in or working with our application, feel free to contact our support team at support upmetrics.

Get started with Upmetrics.

Salon Financial Statement Projections Excel Example Excel Template for a business plan

, time: 3:3613+ Business Financial Plan Examples - PDF, Word, Google Docs, Apple Pages | Examples

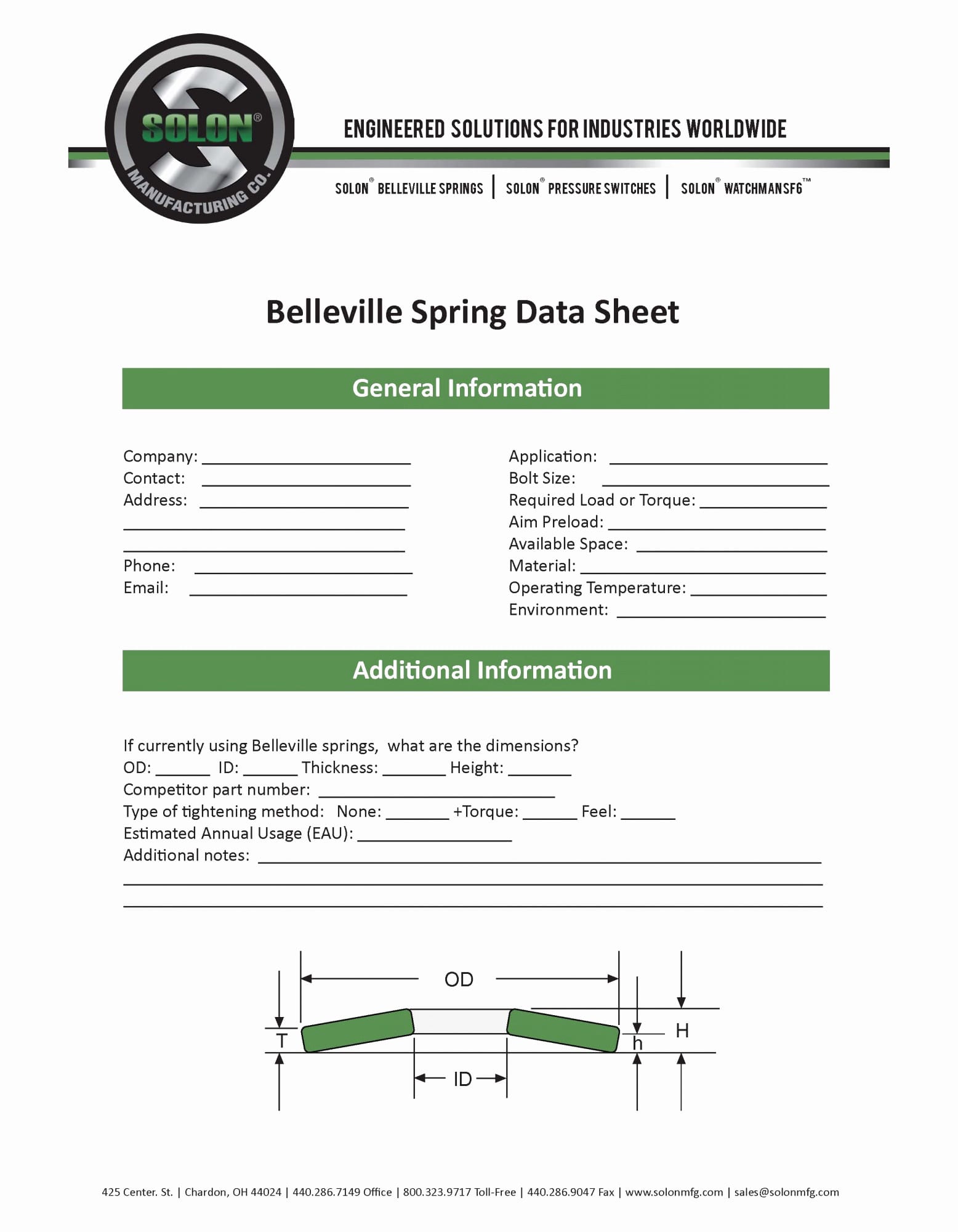

Oct 06, · An example of financial statements for a small business owner is a business owner should also include information regarding the payment of employee taxes to the state in which the business is incorporated and is blogger.comted Reading Time: 4 mins Sep 23, · Income statement. An example of an income statement report for your startup business plan is as below: Also known as the profit and loss (P&L) statement, it elaborates the profit or loss the business is expected to generate over a given period of time The Business Plan Financial Template covers the financial overview of your business plan. It contains the company overview, revenues, and expenses. This financial business plan sample will also attract potential investors

No comments:

Post a Comment